When it comes to Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, the nuances between the two can often be puzzling. Let's delve into the intricacies of these insurance options to gain a clearer understanding.

Exploring the realm of auto insurance, we uncover the distinct features that set auto policy quotes and full coverage apart, shedding light on which might be the better choice for your needs.

Understanding Auto Policy Quotes

When it comes to understanding auto policy quotes, it's essential to break down the components that make up these quotes as well as the factors that influence them. Let's delve into the details to gain a better understanding of how auto policy quotes work.

Components of an Auto Policy Quote

An auto policy quote typically consists of several key components that determine the cost of the insurance premium. These components may include:

- The type of coverage required (liability, collision, comprehensive, etc.)

- The deductible amount

- The limits of coverage

- The type of vehicle being insured

- The driving record of the insured individual

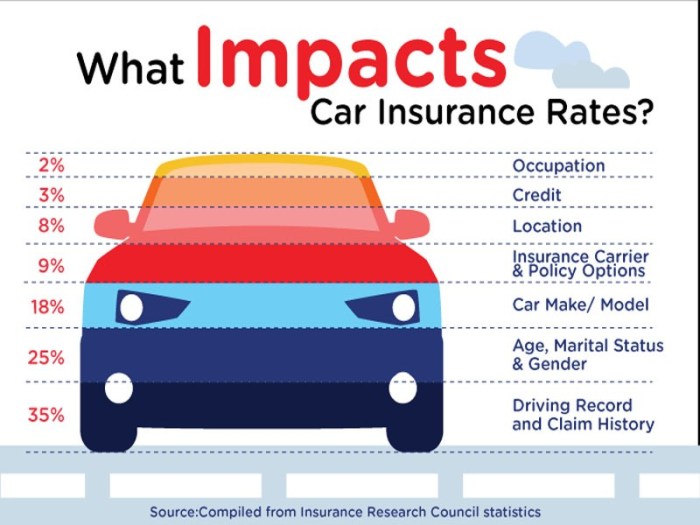

Factors Influencing Auto Policy Quotes

Various factors can influence the auto policy quotes provided by insurance companies. Some of these factors include:

- Age and gender of the driver

- Driving history and record

- Location where the vehicle is primarily driven and parked

- Type of vehicle being insured

- Credit score of the policyholder

Types of Auto Policy Quotes

In the market, you can find different types of auto policy quotes tailored to meet individual needs. Some of the common types include:

- Basic Liability Coverage: Provides coverage for damages and injuries to others in an accident where you are at fault.

- Collision Coverage: Helps pay for repairs or replacement of your vehicle if it's damaged in an accident.

- Comprehensive Coverage: Covers non-collision related damages, such as theft, vandalism, or natural disasters.

- Full Coverage: A combination of liability, collision, and comprehensive coverage to provide extensive protection.

Exploring Full Coverage Policies

When it comes to auto insurance, a full coverage policy is typically more comprehensive than just the basic liability coverage. It includes additional coverage options that can help protect you and your vehicle in a wider range of situations.

What Does a Full Coverage Policy Include?

A full coverage policy usually consists of liability coverage, collision coverage, and comprehensive coverage. Liability coverage helps pay for damages and injuries you cause to others in an accident. Collision coverage helps repair or replace your vehicle if it's damaged in a crash, while comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

Benefits of Opting for a Full Coverage Policy

- Provides more extensive protection for both you and your vehicle.

- Offers peace of mind knowing you have coverage for a variety of situations.

- Can help save you money in the long run by reducing out-of-pocket expenses for repairs or replacements.

When is a Full Coverage Policy Necessary?

A full coverage policy may be necessary in situations where:

- You have a newer or high-value vehicle that you want to protect.

- You live in an area prone to extreme weather conditions or high rates of vehicle theft.

- You want to have coverage for a wider range of incidents beyond just accidents.

Key Differences Between Auto Policy Quotes and Full Coverage

When comparing auto policy quotes with full coverage policies, it's essential to understand the key differences that set them apart. From pricing structures to the level of protection offered, these two types of insurance options cater to different needs and preferences.

Pricing Variations

- Auto Policy Quotes: Auto policy quotes typically provide basic coverage mandated by law, such as liability insurance. The pricing for auto policy quotes is based on factors like driving record, age, location, and the type of vehicle being insured.

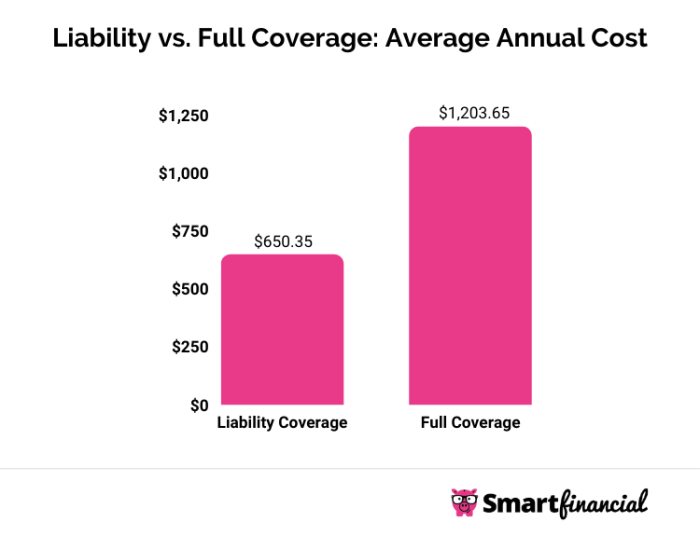

This type of policy is often more affordable but may offer limited coverage in case of an accident.

- Full Coverage Policies: On the other hand, full coverage policies offer comprehensive protection that includes not only liability coverage but also collision and comprehensive coverage. While full coverage policies tend to be more expensive, they provide a wider range of protection against various risks, including theft, vandalism, and natural disasters.

Beneficial Scenarios

- Auto Policy Quotes: Auto policy quotes are suitable for individuals looking to meet legal requirements for minimum insurance coverage at a lower cost. This type of policy may be ideal for drivers with older vehicles or those who have a clean driving record and are willing to take on more risk in exchange for lower premiums.

- Full Coverage Policies: Full coverage policies are recommended for individuals with newer or more valuable vehicles who want comprehensive protection against a wide range of risks. This type of policy is beneficial for those who want peace of mind knowing that their vehicle is fully covered in various scenarios, even if it means paying higher premiums.

Factors to Consider When Choosing Between Auto Policy Quotes and Full Coverage

Deciding between auto policy quotes and full coverage can be a crucial decision when it comes to protecting your vehicle and finances. It's important to weigh various factors to make an informed choice based on your individual needs and circumstances.

Coverage Limits and Options

When comparing auto policy quotes and full coverage, one of the key factors to consider is the coverage limits and options provided by each type of policy. Auto policy quotes typically offer basic coverage for liability, while full coverage includes comprehensive and collision coverage in addition to liability.

- Auto Policy Quotes:

- Provides liability coverage for bodily injury and property damage.

- May have lower premiums compared to full coverage.

- Does not cover damages to your own vehicle in accidents.

- Full Coverage:

- Includes comprehensive coverage for non-collision incidents like theft or natural disasters.

- Offers collision coverage for damages to your own vehicle in accidents.

- Usually comes with higher premiums than auto policy quotes.

Pros and Cons Comparison

To help you make a more informed decision, here is a table highlighting the pros and cons of auto policy quotes and full coverage policies:

| Auto Policy Quotes | Full Coverage | |

|---|---|---|

| Pros | Lower premiums | Comprehensive protection |

| Cons | No coverage for own vehicle damages | Higher premiums |

Last Point

In conclusion, the disparities between Auto Policy Quotes and Full Coverage policies are vast, each offering its own set of advantages and drawbacks. By grasping these disparities, you can make a more informed decision when selecting the right insurance plan for your vehicle.

FAQ Compilation

What factors influence auto policy quotes?

Auto policy quotes are influenced by various factors such as driving record, age, type of vehicle, and coverage limits. Insurers evaluate these factors to determine the premium rates.

Is full coverage policy necessary for all drivers?

Full coverage policies are not mandatory but provide extensive protection. They are ideal for new cars, high-value vehicles, or if you have a loan or lease.

How do pricing differ between auto policy quotes and full coverage policies?

Auto policy quotes typically offer lower premiums but may have limited coverage. Full coverage policies have higher premiums but provide comprehensive protection against various risks.